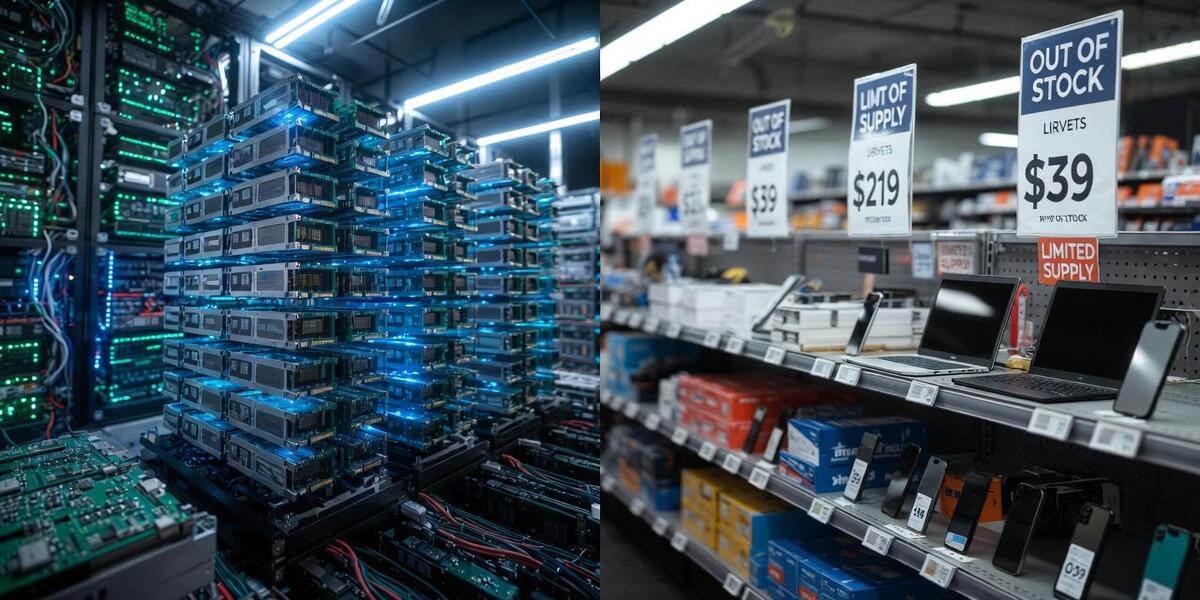

Consumer electronics prices will remain elevated in 2026 as memory chip manufacturers prioritize data center orders over PC and smartphone production due to surging AI demand.

The shift reflects a fundamental rebalancing in the semiconductor industry. Data centers building AI infrastructure require massive quantities of high-performance memory chips, creating unprecedented demand that outstrips supply. Memory manufacturers are responding by allocating production capacity toward these lucrative data center contracts, leaving consumer electronics makers competing for a shrinking pool of available chips. This supply constraint will translate directly into higher costs for anyone looking to purchase new computers or mobile devices throughout the year.

Data Centers Dominate Memory Allocation

AI training and inference operations consume extraordinary amounts of memory. A single large language model training run can require thousands of high-bandwidth memory chips working in parallel. Companies like Microsoft, Google, Amazon, and Meta are racing to expand their AI capabilities, each ordering memory components in volumes that dwarf traditional consumer electronics demand.

Memory manufacturers face production capacity limits. Fabrication plants cannot instantly scale output, as building new facilities requires billions in capital investment and years of construction time. Existing production lines must choose between fulfilling data center orders at premium prices or consumer device orders at lower margins.

The economics favor data centers overwhelmingly. Micron Technology and other major producers can command significantly higher prices for memory modules optimized for AI workloads. High-bandwidth memory (HBM) used in AI accelerators sells for multiples of standard DRAM pricing, making data center customers far more profitable than PC manufacturers.

This dynamic creates a cascading effect through consumer markets. PC makers like Dell, HP, and Lenovo must compete for remaining memory supply, driving up their component costs. These increased expenses flow through to retail pricing, making laptops and desktops more expensive for end users.

Smartphone Market Faces Similar Pressures

Mobile device manufacturers confront identical challenges. Premium smartphones require substantial memory for performance and multitasking, but memory producers prioritize data center orders. Apple, Samsung, and other phone makers face constrained supply and higher prices for the memory chips they need.

The smartphone market already operates on thin margins for many manufacturers. Additional memory costs squeeze profitability further, forcing companies to either raise retail prices or reduce specifications. Some manufacturers may opt to include less memory in base models, creating a tiered market where only expensive flagship devices offer adequate performance.

Emerging markets feel these pressures acutely. Budget smartphones that previously offered good value now face component shortages that push prices upward or reduce availability. This could slow smartphone adoption in developing regions where affordability remains the primary purchasing factor.

Industry Response and Mitigation Efforts

Some memory manufacturers are announcing capacity expansion plans, though these will take time to materialize. Samsung and SK Hynix have committed to building new fabrication facilities, but such plants typically require three to five years from groundbreaking to production.

In the shorter term, manufacturers are exploring efficiency improvements to existing production lines. Process refinements and yield improvements can incrementally increase output without new construction. However, these gains are measured in percentage points rather than the multiples needed to satisfy both data center and consumer demand simultaneously.

PC and smartphone makers are also adapting their strategies. Some are designing products that use memory more efficiently, allowing them to offer competitive performance with less physical memory. Others are locking in long-term supply contracts, accepting higher prices now to ensure component availability later.

Consumer Impact and Market Outlook

Consumers planning electronics purchases in 2026 should expect limited discounting and higher base prices compared to pre-AI-boom pricing. The days of aggressive price competition in the PC market appear unlikely to return while memory supply remains constrained.

The used electronics market may see increased activity as buyers seeking value turn to refurbished or secondhand devices. This shift could extend the useful life of existing products while providing alternatives to expensive new purchases.

Enterprise buyers face similar challenges but with different consequences. Businesses delaying IT upgrades to avoid inflated prices risk running outdated equipment longer, potentially impacting productivity and security. Companies must weigh immediate cost savings against longer-term operational risks.

Industry analysts suggest the supply-demand imbalance could persist through 2027 or beyond, depending on how quickly new production capacity comes online and whether AI infrastructure buildout slows. Until memory supply catches up with combined data center and consumer demand, prices will likely remain elevated across all segments.

The situation illustrates how AI’s rapid growth creates ripple effects throughout technology markets. What benefits cloud providers and AI companies directly impacts millions of consumers indirectly through higher costs and reduced availability of everyday electronics.